On Thursday (August 26), due to the presence of the Inhol Hall global market, copper and other industrial metals fell back in a row, ending the interest in entrepreneurship and rebounding in the commodity futures market. In the above, a reaction appeared after a lapse of time, which is making some copper market leaders smell the potential possibility-refined copper prices and scrap copper prices.

Colin Hamilton, general

manager of the Commodity Research Department of the Bank of Montreal, said this

week that buyers appear to have re-entered the market after months of

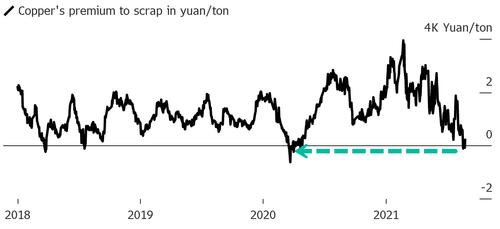

correction in copper prices. He pointed out that the spot price of high-grade

copper scrap in China was higher than the price of refined copper last weekend.

This strongly shows that the supply of scrap copper is rapidly decreasing.

The last time this scene appeared was back in

April last year, when global central banks and governments injected trillions

of stimulus funds into the economy. The LME copper

futures soared after bottoming out in the first quarter of that year, breaking

the $10,000 mark in one fell swoop in May of this year, and setting a new

historical high of $10,747.

Hamilton pointed out that

rising scrap copper prices and insufficient supply have caused some demand to

shift to the direct purchase of refined copper, which may push up the latter's

prices.

Colin Hamilton

believes, "This trend is obviously unusual. Although it does not make much

sense at the economic level, it is a sign that the market sell-off may have

exceeded the fundamentals itself. We do see some preliminary signs that China

Buyers have stopped destocking and are returning to the market."

Although copper

prices have fallen in the past few months, LME copper prices have still risen

by 126% since the low point of the epidemic last year, and the overall upward

trend has not completely changed.

Copper prices are

firm in the outlook.

Copper is used in

power and construction fields. Many analysts expect that as fossil fuels are

replaced by electrification, demand for copper will be very strong. In fact, in

addition to the above-mentioned rare inversion between scrap copper and refined

copper prices, in some other areas, there is no lack of signs of optimism about

the outlook for copper prices.

China’s Yangshan copper import premium has recently risen from US$21 per ton in June to more than US$100, which shows that the Chinese market has stronger demand for overseas metals. China has always been the world’s largest copper buyer in the physical market.

"I don't see the real reason to be short... there is room for record-breaking," Gianclaudio Torlizzi of consulting firm T-Commodity said on Wednesday. He also pointed out that high inflation expectations, declining inventories, rising Chinese import premiums, and positive demand prospects are all supporting prices.

On the technical

level, Torlizzi predicts that as long as the copper price can stay above the

200-day moving average cut-in level of $8,880, the technical side will be

improved. The latest trading of LME copper futures on Friday was at 9297 US

dollars.

Goldman Sachs analyst

Christian Mueller-Glissmann also pointed out recently, "Copper prices may

rise before the end of this year. Our strategists believe that the gap between

supply and demand can help copper prices break the range in the fourth

quarter."

Contact: Manager Gao

Phone: +86-15932423630

Tel: +86-311-89276065

Email: mesh@ht-mesh.com

Add: Wire Mesh Zone,Anping County,Hebei Province,China.